Below we plot the labor force participation rate of men and women over time. The share of women who are either working or looking for work has nearly doubled since 1948, while the share of men has fallen by nearly 20 percent in the same time-period.

Despite the entrance of women into the labor market, the unemployment rate of men has hardly changed over time.

The huge increase in competition for work was not met with any notable difficulty finding work among men. In general, a larger labor force does not imply more difficulty finding work. This holds both when women enter the labor market and when immigrants enter the labor market.

Sunday, December 25, 2011

Sunday, October 30, 2011

Unemployment Flows from Labor Force

Below, Corrections displays the four places the unemployed go, from month to month (click to enlarge). They either find employment, stay unemployed, leave the labor force, or "other" (a very, very tiny category that would include dying, or immigrating, for instance).

Saturday, September 24, 2011

AAA vs. BAA Bond Spreads

Below, Corrections takes the difference between daily AAA and BAA rated bonds (Moody's, from the FRED database) and displays recessions (click to enlarge).

When the data from Operation Twist and the subsequent days become available, we'll put those graphs up too.

When the data from Operation Twist and the subsequent days become available, we'll put those graphs up too.

Labels:

Growth Theory,

Heterogeneity,

Housing Crisis,

Risk-Taking

Friday, September 9, 2011

Ratio of Job Seekers to Job Openings

Below, Corrections displays the number of unemployed, the number of job openings, and the ratio between the number of unemployed and the number of job openings (e.g. number of seekers per position that month) up until July 2011. If job openings increased to where they were in 2007, then 70% gap between today and the average of the seeker-opening ratio would be closed.

Saturday, September 3, 2011

Three Charts (not) to Email to Your Right-Wing Brother-In-Law

Truth-out.org suggests “Three Charts to Email to Your Right-Wing Brother-In-Law". Here are a few pictures to think about before you do so.

The graphs created by truth-out.org select the last year of the Bush presidency (not his entire term) to note that the recession started in 2008. Recessions actually happen very frequently in the US economy. This gives us a wealth of data with which to compare the current President’s performance. The first graph in the picture below plots the trends of many recessions. We evaluate using the same basis as truth-out.org--national employment statistics. In particular, we plot the employment as a percentage of its lowest value during a recession over time, for a number of recessions (from 1950 on). We can look at the growth of employment after the trough of a recession. Usually, the economy recovers rather quickly; in the graph, this corresponds to a steep uptick after hitting 0.

The current recession is the very bottom black line on the graph. This means that currently, we’re doing worse than any recession in the past 60 years in terms of recovery. Since Obama had been president for months before the trough, it wouldn’t seem natural to blame Bush alone for the slowest recovery that we have seen in the last 60 years. Just below the first graph, there is a comparison our recession--the blue line--with the average recovery after a recession. We are doing a poor job relative to the average.

In the second column, we look at another interesting trend: job growth before and after the passage of Obamacare. While the country seemed to be recovering at a reasonable rate and coming out of the recession before the passage of this bill, job growth slowed dramatically immediately following the passage of Obamacare in April 2010. Below this, the last graph depicts the actual stimulus rollout. The solid black line depicts funds received by organizations from the stimulus. Contrary to the deceptive picture painted by truth-out.org, the stimulus has been doled out at a fairly constant, increasing rate since the beginning of 2009. The article from truth-out.org, however, makes the ridiculous suggestion that the slowing of job growth and the constant unemployment rate is caused by the stimulus “winding down”. That is false. Just because there is no bill on the table doesn't mean that our economy isn't being "stimulated," and these are the results.

The graphs created by truth-out.org select the last year of the Bush presidency (not his entire term) to note that the recession started in 2008. Recessions actually happen very frequently in the US economy. This gives us a wealth of data with which to compare the current President’s performance. The first graph in the picture below plots the trends of many recessions. We evaluate using the same basis as truth-out.org--national employment statistics. In particular, we plot the employment as a percentage of its lowest value during a recession over time, for a number of recessions (from 1950 on). We can look at the growth of employment after the trough of a recession. Usually, the economy recovers rather quickly; in the graph, this corresponds to a steep uptick after hitting 0.

The current recession is the very bottom black line on the graph. This means that currently, we’re doing worse than any recession in the past 60 years in terms of recovery. Since Obama had been president for months before the trough, it wouldn’t seem natural to blame Bush alone for the slowest recovery that we have seen in the last 60 years. Just below the first graph, there is a comparison our recession--the blue line--with the average recovery after a recession. We are doing a poor job relative to the average.

In the second column, we look at another interesting trend: job growth before and after the passage of Obamacare. While the country seemed to be recovering at a reasonable rate and coming out of the recession before the passage of this bill, job growth slowed dramatically immediately following the passage of Obamacare in April 2010. Below this, the last graph depicts the actual stimulus rollout. The solid black line depicts funds received by organizations from the stimulus. Contrary to the deceptive picture painted by truth-out.org, the stimulus has been doled out at a fairly constant, increasing rate since the beginning of 2009. The article from truth-out.org, however, makes the ridiculous suggestion that the slowing of job growth and the constant unemployment rate is caused by the stimulus “winding down”. That is false. Just because there is no bill on the table doesn't mean that our economy isn't being "stimulated," and these are the results.

Thursday, July 7, 2011

Reported Satisfaction with Life across Countries

A look into life satisfaction across countries yields interesting regional and historic patterns. In the graph below (click here to enlarge), we plot average reported life satisfaction against national GDP per capita (2006 figures). Responses to the question "are you satisfied with your life?" were on a scale from 1-10, with 10 indicating "satisfied."

From this, one trend stands out starkly--the similarity of response across formerly communist and eastern european nations as well as the similarity of response across developed western economies (in particular across largely Protestant nations). There is a great gulf, however, between the reported life satisfaction of these formerly communist nations and western nations. The graph below (click here to enlarge) gives the distribution of satisfaction with life from 8 formerly communist eastern european nations and 8 western, non-communist nations. The countries are ordered by GDP per-capita. Numbers are in terms of deviations from average reported levels, in order to make the differences more stark. A green area indicated a higher concentration of responses than a red area. We see that the concentration of reported life satisfaction is increasing with GDP and in general is fairly uniform across formerly communist nations and across western non-communist nations.

From this, one trend stands out starkly--the similarity of response across formerly communist and eastern european nations as well as the similarity of response across developed western economies (in particular across largely Protestant nations). There is a great gulf, however, between the reported life satisfaction of these formerly communist nations and western nations. The graph below (click here to enlarge) gives the distribution of satisfaction with life from 8 formerly communist eastern european nations and 8 western, non-communist nations. The countries are ordered by GDP per-capita. Numbers are in terms of deviations from average reported levels, in order to make the differences more stark. A green area indicated a higher concentration of responses than a red area. We see that the concentration of reported life satisfaction is increasing with GDP and in general is fairly uniform across formerly communist nations and across western non-communist nations.

Monday, July 4, 2011

Imprisonment, Torture, Killings and Assassinations

There have been several interesting stories about the cost of imprisonment, torture, killing and assassinations in the U.S.'s War on Terror. For example, in Afghanistan one often hears of an ineffective criminal justice system causing the U.S. military to release captured militants in the hopes that they can kill them next time. Similarly, this news article discusses the Obama administration's increased reliance on assassination attempts in, for example, Yemen, Afghanistan, and Pakistan.

Corrections suggests that this is in accordance with the Obama administration's decreased reliance on torture and the substitutability between targeted assassinations and capture and torture. This is depicted graphically below (click to enlarge). The straight red line depicts the Bush administration's capability to substitute capture and torture for assassinations. The curved line depicts their preferences, and the red dot depicts the best mix of capture and killing. We can imagine that the Obama administration through rhetoric has decreased its capacity to capture and torture terrorists (if only due to political ramifications). They retain the same ability to kill as the Bush administration, so their budget line is the straight blue line. If killings and assassinations are substitutable enough (for example) then it's possible the Obama administration will not only substitute away from torture and toward assassination but will actually have more assassinations (rather than less of both), which can be seen as the blue dot.

Corrections suggests that this is in accordance with the Obama administration's decreased reliance on torture and the substitutability between targeted assassinations and capture and torture. This is depicted graphically below (click to enlarge). The straight red line depicts the Bush administration's capability to substitute capture and torture for assassinations. The curved line depicts their preferences, and the red dot depicts the best mix of capture and killing. We can imagine that the Obama administration through rhetoric has decreased its capacity to capture and torture terrorists (if only due to political ramifications). They retain the same ability to kill as the Bush administration, so their budget line is the straight blue line. If killings and assassinations are substitutable enough (for example) then it's possible the Obama administration will not only substitute away from torture and toward assassination but will actually have more assassinations (rather than less of both), which can be seen as the blue dot.

Labels:

Political Economy,

Unintended Consequences

U.S. Log GDP with Error Bands of +/-3%

Below, Corrections depicts our own version of Figure 2.4 in Ed Leamer's Macroeconomic Patterns and Stories. It depicts, from the perspective of 1970, log GDP. Then, from 1970+3% GDP  and 1970-3% GDP, it simulates a permanent 3% growth trend. One can see that growth, remarkably, stays within this rather narrow corridor.

and 1970-3% GDP, it simulates a permanent 3% growth trend. One can see that growth, remarkably, stays within this rather narrow corridor.

Sunday, July 3, 2011

Forecasting June's Payroll Change

Below, I depict on the Y-axis the change in payroll jobs. On the x-axis the average growth in payroll jobs in the three months preceding that month. The red line is the average growth in the three months preceding July 2011. This joint distribution may give an idea of what to expect from this month's payroll figures.

Saturday, July 2, 2011

Argentine Break

Detrended Argentine real GDP/capita 1950-2008 (detrended at 2%). Recall that a straight horizontal line represents a constant 2% growth rate. Note the break from 1979-1980 onward (click to enlarge).

U.S. Federalism

Below, Corrections depicts the relatively stable pie of relative U.S. government spending per year between the Federal government and State/Local governments (click to enlarge). Since 1956, a relatively steady progression of relative expenditures back to the states, after a large Federal government expansion during the Great Depression and World War II.

Four Great Depressions

Corrections has been reading Great Depressions of the Twentieth Century (Kehoe and Prescott, eds.), and found it intoxicating. Below, Figure 1 from Kehoe and Prescott's first chapter: detrended GDP/capita for four countries between and including 1928 to 1938 (click to enlarge).

(Kehoe and Prescott, eds.), and found it intoxicating. Below, Figure 1 from Kehoe and Prescott's first chapter: detrended GDP/capita for four countries between and including 1928 to 1938 (click to enlarge).

The severity of the decline in detrended real GDP/capita is quite large. Remember, staying at the starting line of 100 requires 2% growth every year.

Friday, July 1, 2011

A stroll down memory lane

In January of 2009, Christine Romer and Jared Bernstein predicted the effect of the coming stimulus on unemployment (full text available here). Inspired by others, we look at how well grounded these predictions turned out to be. Below is the monthly series of actual unemployment (the red dots) superimposed over the Romer and Bernstein predictions. They provided predictions of both what the world would look like with the stimulus (the dark blue line) and what it would look like without a stimulus (the light blue line). More than woefully incorrect, these predictions suggest that world we live in post-stimulus is worse than the apocalyptic outcome of the government doing nothing, as imagined by these supporters of the failed stimulus.

(click here to enlarge)

(click here to enlarge)

Lottery Winners

Winning a $10,000 lottery doesn't change the chance individuals declare bankruptcy. Winning between $50,000 and $150,000 only forestalls it. This from Hankins, Hoekstra, and Skiba (Review of Economics and Statistics, Forthcoming: "The Ticket to Easy Street? The Financial Consequences of Winning the Lottery").

Below, they produce the relative probability that an individual declares bankruptcy before and after winning the lottery in two different amounts (click to enlarge). The probability doesn't change for individuals winning less than $10,000. The probability dips for two years after winning more than $50,000, but the next three years make up for that deficit.

Below, they produce the relative probability that an individual declares bankruptcy before and after winning the lottery in two different amounts (click to enlarge). The probability doesn't change for individuals winning less than $10,000. The probability dips for two years after winning more than $50,000, but the next three years make up for that deficit.

Remarkably clever paper.

Rule of thumb: cash transfers to the poor do nothing in the long run.

Labels:

Altruism,

Efficiency,

Political Economy

Sunday, June 12, 2011

Bayesian Updating about a Politician During a Sex Scandal

Every once in a while, Corrections hears the erroneous argument that we shouldn't care about politicians having sex scandals. Another version of the argument goes that we should only care about Republicans having sex scandals, for various reasons. Corrections argues that even when one does not care at all about a politican's personal life, they should care and often condemn a politician in light of a sex scandal.

Why? We posit that all politicians are unknowns. We can imagine they have two traits: degree to which they engage in extramarital affairs and the degree to which they are willing to steal from the taxpayer. Further, we argue these two traits are correlated. So, we might have a multivariate normal with a covariance matrix with non-zero entries, as depicted in 3D in Figure 1 below (click to enlarge).

Why? We posit that all politicians are unknowns. We can imagine they have two traits: degree to which they engage in extramarital affairs and the degree to which they are willing to steal from the taxpayer. Further, we argue these two traits are correlated. So, we might have a multivariate normal with a covariance matrix with non-zero entries, as depicted in 3D in Figure 1 below (click to enlarge).

So, most likely (on average) the unconditional politician is at (0,0). But what happens if we find out he's a philanderer? Then, looking at this image from the perhaps more clear "birds eye view", we see that our new belief about him is that not only is he a philanderer, but he's also dishonest (click to enlarge). The first, left hand circle is what we believe about a politician unconditionally, e.g. before the scandal. Conditional on discovering he is a philanderer pushes us to the right of the graph. Updating about his dishonesty, we find ourselves at a higher point there, as well!

There are, of course, more complex ways to do this, but the point is made: when distributions are not independently distributed, then information on a trait that you may not care about at all should influence your beliefs about something you do care about.

University of Michigan Sentiment Survey

The University of Michigan's sentiment survey doesn't seem to be incredibly stable. Instead, it seems incredibly noisy for a number thats used so frequently in the press for month to month comparisons (click to enlarge):

Employment to Population Ratio

Below, Corrections offers the employment to population ratio (click to enlarge). Note the sharp effects of recessions and our current stagnated ratio.

Labels:

Data: Employment Situation,

Housing Crisis

Standard Deviation of the Unemployment Rates in All 50 States

Corrections was idly looking at the unemployment rate in all 50 states over time (click to enlarge):

Other than the "Hurricane Katrina" effect for Mississippi and Louisiana and the Great Recession, the most interesting thing to come out of this graph is the increase in dispersion between the states. Below, find each month's standard error between states (click to enlarge). Pretty remarkable.

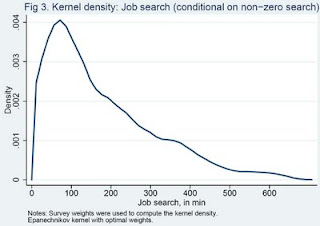

Job Search

The jobless don't seem to look for jobs very hard. From Alan Krueger and Andreas Mueller's 2008 working paper, "Job Search and Unemployment Insurance: New Evidence from Time Use Data", it appears that jobless looking for jobs spend about 41 minutes a day looking. Below, find the distribution of working time (given that they are looking) (click to enlarge).

Rather remarkable.

U.S. Debt Structure

From the database associated with Hamilton and Wu (Forthcoming) ""The Effectiveness of Alternative Monetary Policy Tools in a Zero Lower Bound Environment," (data) (paper). The maturity structure of U.S. Debt. "Strands" that disappear in the middle indicate debt structure altered by open market operations. Strands that cease "starting" indicates that bond maturity is no longer issued (for example, the 5 year bond was retired for some time in the 90's). The first figure is thirty years of maturities (click to enlarge).

This second year looks only at the distribution of U.S. bonds with maturities of five years or sooner (click to enlarge).

No Bubble #2

An old paper from Greg Mankiw and David Weil, "The Baby Boom, The Baby Bust, and the Housing Market" (1989) offers one possible reason for the transitions we've seen in housing prices: an anticipated baby boom. The paper offers nice depictions in dynamics that Corrections wishes were present in more papers. If the boom is transitory, we have supply and demand temporarily moving and falling back down along the same supply curve (click to enlarge)

Or, offers a graph that might be informative about our current housing issues: what would happen to housing prices in a forward-looking and a naïve world under a baby boom (click to enlarge):

Look familiar? (In shape, not in magnitude!) Almost like a partially-anticipated, rational boom that dissipated when the state of the world turned out to be different.

Labels:

Housing Crisis,

Rational Expectations

No Bubble

Was there a housing bubble? For people who think there was, aren't we still in it? When will it pop? Housing has fallen less than half of its "bubble" high (click to enlarge).

Weekly Jobless Claims - Advance Estimates and Final Estimates

Whenever one reads the weekly jobless claim update, one of the highest frequency datasets out there, there are always two new pieces of information in the top line: the advance numbers for that week, and the revised estimate for the previous week. The revised estimate is always higher than the advance numbers, because there are more delayed unemployment claims. This would be an innocuous difference, but newspapers and even the report itself always compare the current week's (underestimated) numbers to the last week's (not-underestimated) numbers. They're always overstating how good this week looks compared to last, and not always by the same amount, as we depict graphically below (click to enlarge). The figure displays the difference between initial and final estimates for the last few months.

June 2011 JOLTS Release: April 2011's Beveridge Curve

Using the recent unemployment rate from the CPS and yesterday's JOLTS release, Corrections offers an updated Beveridge curve (click to enlarge). Note the adjusted axes, so that recent trends can be seen more easily.

Israeli Hyperinflation

Israel's 1983 hyperinflation, from Sargent and Zeira (2011): Israel 1983: A bout of unpleasant monetarist arithmetic (click to enlarge).

Drinking Age

Christopher Carpenter and Carlos Dobkin produce a great figure in their article "The Minimum Legal Drinking Age and Public Health" in this Spring's Journal of Economic Perspectives. The figure reconstructs causes of death by age (in months). It then runs a best fit line before and after individuals are twenty-one (click to enlarge).

Whether or not you support lowering the legal minimum drinking age, as Corrections does, this graph powerfully the idea behind what being able to drink entails.

Whether or not you support lowering the legal minimum drinking age, as Corrections does, this graph powerfully the idea behind what being able to drink entails.

State+Federal+FICA Marginal Tax Rates by Income by State

Below, Corrections offers and abstract view of marginal tax rates by state by income (click to enlarge). The quite dramatic dropoff after $102,000 comes from the absence of payroll tax.

Raw data extracted using TaxSim version 9.

Raw data extracted using TaxSim version 9.

Congressional Budget Office Predictions and the Truth

Below, Corrections has taken nominal GDP growth predictions from 2000-2011 from the CBO and plotted them against the truth (click to enlarge). The CBO doesn't seem to systematically overpredict or underpredict one-year ahead: of ten one-year-ahead predictions, six are over, four are under. (And it's hard to fault more than one year ahead given the time period we're looking at).

Corrections also offers the same graph but with future years included (click to enlarge).

Corrections also offers the same graph but with future years included (click to enlarge).

Europe vs. America: Output and Hours

America in 1970-1974 and 1990-1993 are normalized to 100. These graphs give a comparison between European countries vs. the U.S. in the 70's and in the 90's, with the data from "Why Do Americans Work So Much More Than Europeans?" Prescott (2004).

European vs. American Hours/Capita (click to enlarge)

- In the 70's, Germany, France, the UK, and Japan all worked more hours than the U.S.

- By the 90's, only Japan worked more (and the deficit had closed).

- By the 90's, France worked 68% of the hours Americans worked per capita (capita is defined as all persons aged 15-64.

European vs. American Output/Hours (click to enlarge)

- In the 1970's, the U.S. produced much more per hour than Europe.

- By the 1990's, this was a mixed bag, but everyone closed the deficit save Canada.

- The U.S. just makes more per capita.

Does the U.S. Still Make Stuff?

U.S. Manufacturing Employment over time (click to enlarge):

Corrections disagrees most intensely with people who value manufacturing jobs over jobs requiring creativity.

Corrections disagrees most intensely with people who value manufacturing jobs over jobs requiring creativity.

Labels:

Data: Employment Situation,

Growth Theory

U.S. GDP from 1870-2010 and Trend

Below, Corrections offers its own version of the now relatively-famous graph in Robert Lucas's presentation using Angus Maddison's data (under "Historical Statistics").

The mean-reverting nature of log GDP under a very slow-moving trend supports the idea of the absence of a "unit root" in U.S. GDP.

New Orleans and the impact of Hurricane Katrina on Unemployment

Below, Corrections displays the seasonally adjusted unemployment rate of the New Orleans metropolitan statistical area from 2000-April 2011, along with the national unemployment rate (click to enlarge). Hurricane Katrina's effects on the unemployment rate dissipated within six months.

Tuesday, May 31, 2011

Net Present Value Laffer Curve

Everyone knows the Laffer Curve; it's so simple we can explain it on the back of a napkin. If we tax at 0%, then government revenues will be zero. If we tax at 100%, government revenues will be zero. And we know from last year that if we tax at ~30%, government revenues are positive. So we have some "curve" connecting those three points. Such a curve could be displayed graphically below (click to enlarge). It looks like the top of the curve is 60%. If we have a tax rate of 30%, and increase our taxes to 31%, then we might think we're on the left hand side of the demand curve. This article shows why that's wrong thinking.

Then we can write the different revenue paths as well, the product of taxes and GDP (click to enlarge):

Then we have the net present value laffer curve, where the peak is at 30%. Even though if we raised taxes in this period, our tax revenue would increase, it is more than harmed by the deficits to future growth (click to enlarge).

But taxes have an effect on GDP growth! We might write down some mapping between the two (click to enlarge):

Then, if we only look at constant-tax policies, we have a few GDP growth paths depending on our policy (click to enlarge):Then we can write the different revenue paths as well, the product of taxes and GDP (click to enlarge):

Then we have the net present value laffer curve, where the peak is at 30%. Even though if we raised taxes in this period, our tax revenue would increase, it is more than harmed by the deficits to future growth (click to enlarge).

Rule of thumb: the relevant concept is not the Laffer Curve, it's the net present value Laffer Curve. The NPV Laffer Curve has a much lower peak than the Laffer Curve.

Subscribe to:

Posts (Atom)